There are so many good people right now that are swimming in debt, losing their homes,  or just feeling a ton of fear and uncertainty regarding their own financial situation as well as the financial security of their country and the world.

or just feeling a ton of fear and uncertainty regarding their own financial situation as well as the financial security of their country and the world.

The old plan — study hard, get a good job, work hard, and save what you earn — does not work anymore.

The current education system does not prepare students to understand money or the financial system, and sadly many academics fail to even emphasize its importance or impact on almost everything we do.

Some brief and incomplete history (Part of this taken from Robert Kiyosaki’s recent book and some of the dates and info is taken from CNN):

* In 1913 the Federal Reserve was created, even though the Founding Fathers were very much against a national bank that controlled the money supply. It is not federal or American, it has no reserves, and it is not a bank. This is a bold statement, but  there is a good argument that it basically creates a way for the rich to continue to print money, when needed, to stay in power.

there is a good argument that it basically creates a way for the rich to continue to print money, when needed, to stay in power.

* In 1971, without authorization from congress, President Nixon sealed the deal when he severed the relationship between the US Dollar and Gold. This led to the largest economic boon in the history of the world (and today, in 2009, that boom has busted). Basically, instead of raising taxes, the government can borrow money. And when the dollar is not tied to gold or anything of concrete value, it is simply valued based on the perception of the ability of the lender to repay the amount. The ability for the printing of money without tie to gold, and in order to cover the debts we owe, etc — is where the concerns regarding inflation become disconcerting.

* In August 2007, after one of the largets home mortgage providers in America declared bankruptcy, and problems with sub-prime loans became more evident, global credit started to freeze. To attempt to mitigate the problem, in the span of 3 working days the European Central Bank pumped almost 204 billion Euros into the system (to try and stimulate lending and liquidity).

* On October 9, 2007, the Dow Jones Industrial Average closed at a historic high of 14,164. Things looked good on the surface, so the US presidential campaign virtually glossed over the issue of the economy.

* On Sept 29, 2008, less than a year later, the Dow plunged the single largest amount in its history, dropping 777 points in one day. In the first week of October, 2008, the Dow dropped another 2,380 points.

* June 2009 – the US Government announced it had spent a $94.32 billion budget deficit in the month of June alone, totaling $1.086 trillion deficit in the first 9 months of 2009 alone.

* July 2009 – Being 18 months into the recession, the national US unemployment rate now is standing at 9.5% (with most analysts expect it to grow past 10%). In Michigan, unemployment has reached 15%, the largest unemploment rate in a state for over three decades.

* By September 2009, 650,000 Americans will have used up all of their unemployment benefits (which last a standard of 26 weeks) — with a total of 4.4 million people expected to eventually find this same fate. Other parts of the world are in a catch 22, frightened by how dependent they have become on such a flawed system and at the same time wanting the US economy to succeed because so much of their economy is based on US consumers, etc.

___

Following the old rules of money (e.g. get a stable job, save, live off of retirement funds, etc) — especially when the entire financial system has changed so much – is simply not going to work. In the Agrarian Age, and even the Industrial Age, financial literacy was not as important, as working hard and saving were usually enough.

Today it is not enough.

Understanding rules of money regarding 1. taxes, 2. debt (good uses and bad uses), and 3. inflation, are key in avoiding a lot of the pain that comes when intelligent people feel helpless in the current financial situation.

Can politicians save us?

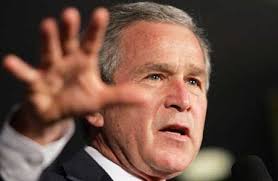

In September 2008, President Bush passed a bill for $700 billion in  bailout money, promising to fix a system that was broken. His father did a similar thing, requesting $66 billion to bailout the Savings and Loan Industry, which shortly went under, and the “rescue” package ended up costing tax payers more like $150 billion. Why would we think that bailout money was going to fix the system? Makes it hard to trust.

bailout money, promising to fix a system that was broken. His father did a similar thing, requesting $66 billion to bailout the Savings and Loan Industry, which shortly went under, and the “rescue” package ended up costing tax payers more like $150 billion. Why would we think that bailout money was going to fix the system? Makes it hard to trust.

President Obama’s slogan is Change We Can Believe In, yet why does he have so many of the same economic advisers as the Clinton administration?

Robert Rubin, Larry Summers, and Timothy Geithner all contributed to the repeal of the Glass-Steagal Act of 1933, which was put in place after the last great depression to protect us against the risky banking investments (e.g. the derivative investments) that brought the collapse. Why would they repeal it in the first place, and then why would we want them to lead the financial future of our country now?

Why would Obama employ the same men who contributed so much to the current problem? Because politicians are usually in place to maintain the system, not to change it. Perhaps he will be able to change it, but how with the current system and players in place is that possible? It seems unlikely.

In mid-December 2008, USA Today asked the banks what they were doing with the bailout money.

* JP Morgan Chase (received $25 billion) said “We have not disclosed that to the public. We are declining to.”

* Morgan Stanley (received $10 billion) said “We are going to decline to comment on your story.”

* The Bank of New York Mellon responded “We’re choosing not to disclose that.”

The truth is that it seems the “bailout” is really a bailout for the rich. It is a way whereby taxpayers can pay for the mistakes, and protect the system of supporting the wealthiest individuals and organizations.

Some of the proof lies in trying to find out what happened to the money ($148 billion) that was intended to stimulate lending? The Wall Street Journal reported that there was a decrease in lending by 10 of the top 13 bank recipients of the TARP program.

If any of this seems controversial and confusing to you, join the crowd. Assuming even a portion of it is true, then the question is what can we do?

One of the first steps is becoming more educated about money (and the system behind it). This will help you to be in control of it, instead of letting it control you.

_____

I know this is a ramble which is seemingly not aligned with my typical blog entries, but it is just so important to talk more about, especially when so many people are in such a vulnerable situation.

I could keep on spew out info, but the essence of what I am trying to say is that financial knowledge (including wise approaches to taxes, debt, and inflation) are so important. Knowledge is power.

___

What’s your thoughts:

* Do you feel becoming financially literate is important? Why or why not?

* If so, where have been your best sources for educating yourself financially?

I believe that becoming financially literate is extremely important.

In the Canadian high school system, there is no class that teaches the basics of personal finance. This is mind boggling considering that money is used every day (like reading, writing, and arithmetic).

Without financial education, it is easy to buy into depreciating assets. Taking advantage of the leverage that money offers can put one in a very sound position in life.

All too much I see people getting ruined, rather than rewarded by the powers of compound interest.

Hi Clint

1- I think yes and no; because according to empowerment framework that is expanded in the “measuring Empowerment” book (Narayan. Deep (2005), Measuring Empowerment: Cross-disciplinary Perspectives) there is a “Opportunity Structure” further than “Agency of the poor”. So improvement of financial literate could improve poor’s capabilities, but the Social and political structures in communities and society have other roles. For example openness. If cognizant people couldn’t effect, if there aren’t proper institutions …

Is my thought true??

2-My best sources for educating myself financially: read financial news and analysis about my society financial problems. And discussion or talk to others. I like improve my financial literate through this way, not directly.

Hi Hamid,

Yes – I agree that the systems in place do have a big role in how empowering the education can be.

This is not just for financial education, but any kind.

Still, I suppose once people are more educated, they can help alter and improve the existing systems. (Especially as the existing systems prove ineffective for the emerging globally connected and educated society.)